When Bad Earnings News Turns Into Trading Opportunity

One of the most reliable tells in the market is not how a stock reacts immediately to earnings, but how it behaves after everyone has had a chance to react. Some of the best multi-day moves start from what looks like failure. A stock gaps down hard on earnings, opens weak, and yet by the end of the session finishes green. That sequence matters more than the headline.

Here’s why this setup continues to work.

1. Earnings force price discovery

Earnings events compress decision making. Investors, traders, algos, and institutions are all forced to reprice the stock at once. When a stock is down four percent or more after hours or premarket, pessimism is already baked in before the opening bell. The open gives everyone full liquidity to act on that information. If price still cannot stay down after a full session of trading, that tells you the market disagrees with the initial interpretation.

This is not about our own hope or optimism. It is about us finding inefficiency in the auction process completing and resolving higher.

2. The open is emotion, the close is information

After earnings, the open is dominated by emotion and positioning. Stops trigger. Fast money exits. Narratives spread. The close is where information shows up. A stock that opens red and closes green has absorbed all available sellers and still attracted demand into the close. That is not short covering alone. That is acceptance of higher prices after the news has been fully digested.

Intraday bounces are common. Green closes after bad news are not.

3. Failed downside resets expectations

Markets move on expectations, not absolutes. When earnings disappoint, expectations collapse quickly. If price cannot follow those expectations lower, the bar resets. Suddenly the stock does not need to be perfect. It just needs to be less bad than feared. That reset is often enough to trigger multiple days of upside as positioning realigns.

This is why these moves tend to last longer than one session. You are not trading a bounce. You are trading a belief change.

4. Institutions reveal themselves through patience

Large players rarely chase after hours moves. They wait for liquidity, confirmation, and acceptance. A red to green day after earnings is one of the few times you can actually see that process play out in real time. The stock had every excuse to continue lower and did not.

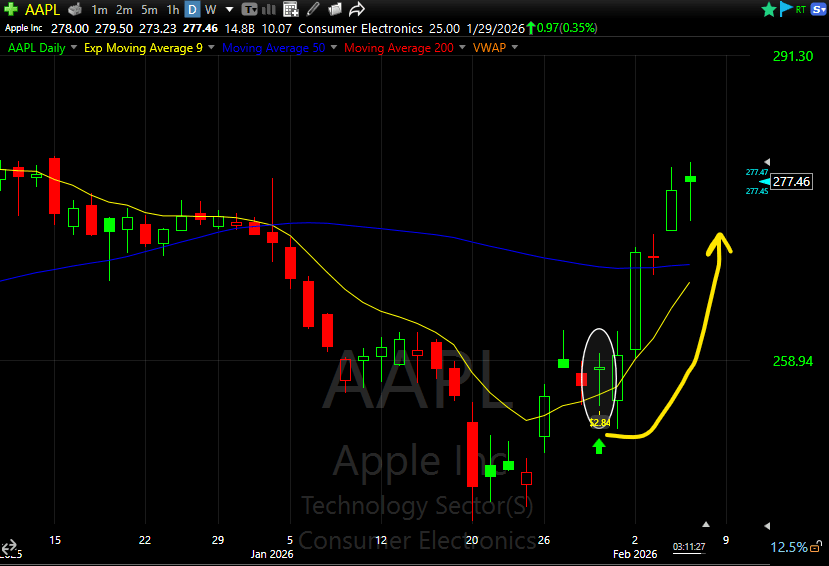

The recent move in Apple Inc. is a perfect example. Earnings were poorly received initially. The stock opened down, reversed by the close, and then followed with a strong multi-day run. That follow through was not luck. It was positioning resolving after failed downside.

5. Strength after bad news matters more than strength after good news

Anyone can buy a stock that gaps up on a blowout quarter. The real information is in stocks that refuse to go down when they are supposed to. Bad news is a stress test. When price passes that test, it often leads to sustained upside because sellers are gone and buyers finally have room to act.

This is why some of the cleanest trades come from uncomfortable headlines and ugly opens. The market is not rewarding the earnings report. It is rewarding the stock for surviving it.

Want more insights on trading?

For more on swing trading check out my swing service at bullsonwallstreet.com

Follow me on twitter and instagram.

Information on Personal Mentoring.

Author Bio

Paul J Singh is a 20+ year trader, Bullonwallstreet.com Swing Trading Coach, and swing trading mentor. He teaches traders how to combine technical analysis, options, risk management, and performance psychology into a repeatable edge.

Leave a comment