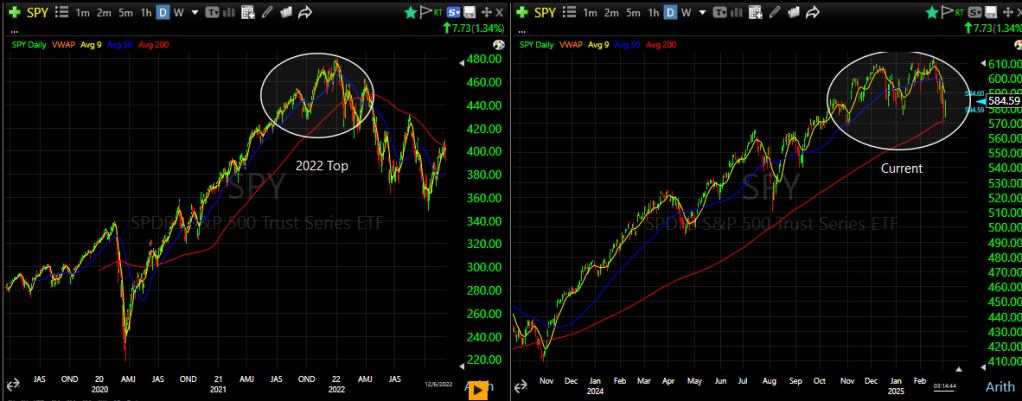

Is SPY Setting Up Like 2022’s Big Drop? Here’s What I’m Seeing

I’ve been staring at SPY’s chart lately—the S&P 500 ETF—and the last 2-3 months are giving me 2022 flashbacks. That year, we hit a top before everything went south fast. I’m not calling a bear market yet—markets don’t let you predict them that easily—but the patterns are close enough to make me pause. Let’s unpack what’s happening, compare it to 2022 with some technicals, look at double tops and other warning signs, and figure out how to prep. Plus, tops don’t always stick—sometimes they fake out and rocket higher—so I’ll cover both sides and how to play them.

2022 Rewind vs. Today

In 2022, SPY topped out around $479 in January. For a couple months, it messed with us—choppy moves, false hopes—before crashing 25% by October. A double top formed late 2021 into early 2022, momentum died, and sellers took over.

Now, March 2025, SPY’s been stuck after a solid run. I’m eyeballing $610-$615 as the recent highs (tweak if I’m off), and it’s not breaking out. Looks like a double top might be cooking. Volume’s telling too—jumps on down days more than up, like sellers are itching to unload. Same deal as 2022: teases you, then traps you. Here’s what the indicators show:

- Moving Averages: 2022 saw the 50-day cross below the 200-day—a “death cross”—post-top. Right now, the 50-day’s still above, but it’s flattening, and the gap’s closing. Not loving that.

- RSI: Back then, RSI hit 70+, got overbought, then diverged—price climbed, RSI didn’t. Today, it’s near 70, stalling, maybe diverging again. Something’s off.

- Volume: Sell-offs in 2022 had big volume. Now, red days are louder than green ones—sellers are showing up.

2022 had Fed hikes hammering us; today’s different. While the Fed is still an issue, no hikes yet. Still, the chart’s got that same uneasy feel. A 2-3 month stall turning sour? I’ve seen it before.

Double Tops and Trouble Spots

Double tops are my bearish bread and butter. Price tags a high twice, can’t bust through, then cracks a support line—the “neckline.” In 2022, SPY hit $475-$479 twice, neckline at $450, then bam—bear market. Now, $615 could be the top, $595-$600 the neckline. If it breaks, heads up.

Other patterns might fit too:

- Head and Shoulders: Big peak, two smaller ones. If SPY shapes up like this, a neckline break means trouble.

- Broadening Top: Wild swings, wider range—could be if volatility spikes before a drop.

- Rounded Top: Slow fade instead of a crash. Maybe that’s where we’re at.

All these scream fading steam and heavier selling. A drop below $600 with volume would seal it for me.

When Tops Flop—and Fly

Here’s the catch: tops don’t always work. 2022 went bearish, but remember 2020? SPY looked topped out in February, then roared back post-COVID dip. If sellers can’t win and support holds, shorts get crushed, and we’re off to the races.

Say SPY powers past $615 with juice—could hit $630 or more. RSI jumping past 70 would back it. Markets love screwing with us, so I’m not sleeping on this either.

How to Play It: Two Plans

Bearish or bullish, I’m not getting caught flat-footed. Here’s the breakdown:

Basics First:

- Watch Levels: $600 and $595 support, $610-$615 resistance. Break either, and it’s go time.

- Check Indicators: RSI and volume don’t lie. Divergences or spikes call the shots.

- Stay Tight: Small positions, stops in place—above $610 for shorts, below for longs.

- Adapt: Things shift fast. Roll with it.

Plan A: Bearish (Top Holds)

- Move: Short SPY or grab puts if $600 cracks with volume.

- Target: Double top drop—$615 to $600 is $15, so $600 – $15 = $585.

- Stop: Above $610. No point bleeding if it flips.

- Why: Matches 2022’s playbook and today’s wobbles.

Plan B: Bullish (Top Busts)

- Move: Go long or buy calls if $615 breaks with gusto.

- Target: $630 or higher—volume and vibes decide.

- Stop: Below $610. Don’t hang on to a dud.

- Why: Failed tops burn bears and fuel runs.

Wrapping It Up

SPY’s 2-3 month dance is pinging my radar—double top vibes, shaky indicators, same old 2022 tricks. But it could fake us out and rip higher. I’m not here to guess the future—just pointing out the risk and saying, “Get ready.” Watch those levels, trust the technicals, and have a Plan A and B. What’s your gut saying—drop or pop? Hit me up in the comments!

For more on swing trading check out my swing service at bullsonwallstreet.com

Follow me on twitter and instagram.

Information on Personal mentoring.

Leave a comment