Today I was working with a trader who became frustrated with my method of mentorship. You see, the lesson just wan’t complicated enough for her.

Huh?

Yeah, I know.

That seems counter-intuitive.

We should want easy, but in fact most humans don’t feel comfortable unless it’s complicated. We feel like we need to be doing more. If it’s too easy, something fishy is going on, so we think.

Experts and Masters Simplify

Well, ever heard of the saying more is less?

This apt cliche applies perfectly to trading.

However, the journey to simplicity is hard (and many times complicated).

Throughout many different fields, expert artists, coders, athletes and traders spend years before they master simplicity.

This is the the key: Experts do not master complexity. They peel “the onion” until they get to the core of what’s important.

Now we have simplicity.

A Simple Setup

I taught my mentoree how to trade a specific setup using only price action and volume, and it only took 20 minutes to teach her the setup.

You would think she’d be thrilled at how quickly we got through it, right?

Wrong.

There are four main elements of the setup that a trader must know for success.

We went over the price action leading to the setup and the required volume pattern. The entry trigger was then illustrated with a few examples. This was overlaid with the ideal market conditions for the setup.

Finally, we discussed the psychology that makes this setup effective.

It Seems To Easy

Then I asked her if she had any questions.

That’s it? She asked.

Yes, that’s it.

Where are the indicators?

You don’t need indicators. Just follow the price action and volume. That’s all indicators measure anyway.

But I read a book that says . . .

Most trading books are garbage.

What about moving averages?

I use them, but not for this particular setup. Just understand the market trend that calls for this setup, find the right stocks and look for the entry signal.

It seems too easy. I need more, she said. What are you not telling me?

The Results From Simplifying

After some more back and forth I asked her to trust me and trade this setup for a month. She said okay, although I could sense her trepidation and lack of confidence.

She met with me after the month was over and told me she had that “light bulb” moment.

After years of unsuccessful trading she had her first winning month of trading.

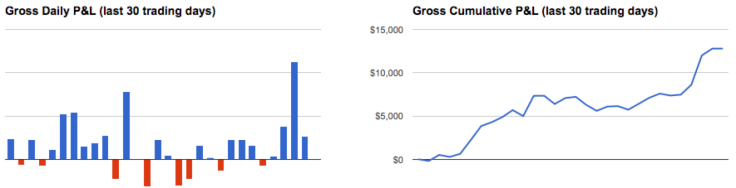

Take a look at her stats over her last 30 trading days:

Yes, I was floored too.

She went from never winning in a month to $12,745 in gains and winning 22 out of 30 days.

After showing me her stats she excitedly showed me her new charting setup.

I was happy to see she had removed RSI, Bollinger Bands and OBV from her charts (she still had stochastics, but I could live with that).

She executed her first winning month with a seemingly simple approach: follow the price action, understand the market psychology and trade the pattern.

That’s it.

Simplifying the process to only what matters lead to better decision making which lead to positive results.

The lesson?

Don’t make trading harder than it needs to be.

In other words, take the complicated road to simplicity.

Wow. Sounds like my story.

Where do I sign

LikeLike

Hey Paul,

Hope you’re well. I’m from the Bulls on Wallstreet Bootcamp. I hear you and Kunal repeat these concepts over and over but it’s still not clicking in my execution. I’m paper trading every day between (market hours) 9:30-12:30. I can be in the green a few days in a row but it’s always a struggle to hit my daily goal. The impending red day always offsets the green and I’m back to breakeven or in the red. I know I’m over-complicating things though- that’s my personality in a nutshell.

I will strip my charts and attempt to trade like that for a while, using price action and volume but it does scare me, I have to say. I understand what you’re saying in principle but don’t know how to re-frame my perspective on it. Can you point me in any direction as to where I could get a better grasp of price action and volume? I know I need to simplify but I don’t know how exactly to simplify. Thanks for any point in any direction.

LikeLike

I need this pattern!

LikeLike